- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Canada jumps into electric vehicle industry

New announcements could spark a surge in electric vehicle production

- By Nate Hendley

- May 24, 2021

- Article

- Made In Canada

The Dana TM4 MOTIVE motor and inverter are turnkey systems optimized for passenger cars and commercial vehicles. Dana

A flurry of electric vehicle (EV) announcements may be foreshadowing major opportunities for Canadian shops that currently serve, or want to serve, the automotive supply chain.

In recent months, three automobile assemblers have revealed plans to build EVs or EV components in Canada that represent investments worth billions of dollars. Auto part giants Magna Intl. and Dana Inc. also intend to expand their EV operations, while other organizations are working on domestic electric car designs.

“These recent announcements [from auto OEMs] are very encouraging, and they couldn’t be timelier, especially considering Canada’s declining auto sector and historically lagging EV production. Over the last two decades, Canada’s motor vehicle production has declined from over 2.5 million [a year] to about 1.9 million, and Canada has had a net loss of five vehicle assembly plants,” said Cedric Smith, an analyst with the Pembina Institute.

Smith co-wrote a white paper in April 2020 called “Power Play: Canada’s Role in the Electric Vehicle Transition.” It revealed that only 9,000 EVs were manufactured in Canada in 2018, the most recent year that statistics were available.

Builds Are Coming

Smith expects this figure to rise if some of the following announcements come to fruition:

- In September 2020 the Ford Motor Co. of Canada and Unifor (the union representing Ford’s autoworkers) came to a labour agreement that includes a plan to build battery EVs (BEVs) at Ford’s Oakville Assembly Complex, Oakville, Ont., in addition to internal combustion engine (ICE) vehicles. A CDN$1.8 billion retooling initiative is required to get the plant ready, after which Ford plans to produce five different BEVs at the plant by 2028.

- In mid-October 2020 Fiat Chrysler Automobiles (FCA) announced its own labour agreement with Unifor. The agreement involves a $1.5 billion venture to build plug-in hybrid or fully electric vehicles in Windsor, Ont. FCA recently merged with French firm Groupe PSA to become a new corporate entity known as Stellantis.

- In January 2021 General Motors unveiled plans to manufacture the BrightDrop EV600 electric commercial vehicles at its CAMI plant in Ingersoll, Ont. The zero-emissions EV600 can go 400 kilometres on a full charge.

Some of these deals have been sweetened with government cash. In October 2020 the federal and Ontario governments each pledged $295 million to help Ford retool its Oakville operations for EV production. Ottawa’s contribution came on top of a previous commitment to spend $300 million for a nationwide series of fast-charging EV stations.

These developments potentially are great news for machine shops, provided they can tweak their operations to accommodate the needs of the EV supply chain. While certain EV components are like components in gas-powered cars, propulsion system parts such as electric motors, transfer cases, and batteries are unique to EVs.

“When we talk about electric vehicle parts, the battery is really quite significant,” said Smith.

Vic Fedeli, Ontario minister of economic development, has said in the past that the province is well-positioned to become an EV-battery manufacturing leader, thanks to an extensive auto supply chain and an abundant supply of nickel, lithium, cobalt, and other materials used to make batteries.

The City of Windsor is working with federal and provincial officials to be the site of a $2 billion EV battery facility, while the Province of Quebec has earmarked nearly $1.5 billion for EV battery manufacturing and R&D.

Some auto part suppliers are ahead of the others. Dana, for example, already has widespread EV operations in Ontario and Quebec, including a facility in Oakville.

“This is a global technical centre of excellence for what we refer to as thermal management products, including thermal management of electric vehicles. This includes things like battery coolers and power electronic coolers,” said Steven Monte, vice-president, Americas, power technologies at Dana Inc.

EV products also are manufactured at a 10,000-sq.-m plant run by Dana in Cambridge, Ont. Between Oakville and Cambridge, the company employs about 230 people.

“The majority of the Cambridge operations today have been shifted towards EV-type components. Going forward, Cambridge, in particular, will be focused on EV products. We expect our EV business to continue to grow and expand,” said Monte.

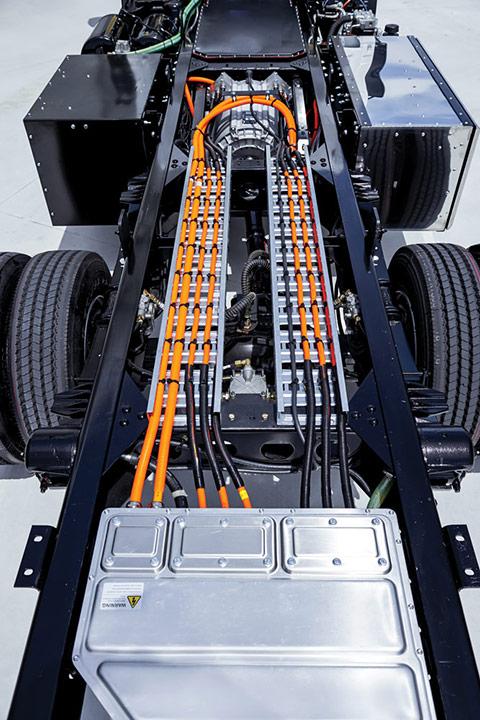

The company also is involved in a joint venture with Hydro-Quebec called Dana TM4. The venture focuses on the manufacture of electric motors, control systems, power electronics, and generators for various OEMs. Components made by Dana TM4 end up in electric passenger cars and commercial, marine, rail, off-highway, and recreational vehicles. This January Dana TM4 unveiled an expanded series of SUMO HP electric motors and inverters for electric vehicles.

Aurora, Ont.-based auto parts maker Magna also has been a pioneer in the EV sector. In December 2020 Magna announced it had formed a joint venture with South Korean company LG Electronics to build e-motors, on-board chargers, e-drive systems, and inverters for EVs. A new firm, tentatively called LG Magna e-Powertrain, will handle these activities.

LG Magna e-Powertrain won’t be setting up shop in Canada, but Magna also is building a facility in St. Clair, Mich., that will hopefully attract nearby Canadian suppliers. In February 2021 Magna broke ground for the 345,000-sq.-ft. plant, which will make battery enclosures for the 2022 GMC Hummer EV.

EV Designs

The Automotive Parts Manufacturers Assoc. (APMA), the trade group representing Canadian auto part makers, has embraced the trend towards electric vehicles. The association is spearheading a venture called Project Arrow to build what it calls Canada’s first, original, full-build concept vehicle. The electric-drive, zero-emissions concept vehicle, called the Arrow, will be designed and engineered in Canada. The APMA currently is arranging suppliers for Project Arrow.

Arkadiusz Kaminski, CEO of fledgling Toronto-area firm AK Motor Intl. Corp., is determined to give the APMA a run for its money. Kaminski wants to build the Maple Majestic, a Canadian EV that he perceives as a boon for the industry.

“There is a symbiotic relationship between part suppliers and OEMs in Canada. If the OEMs were to pull out of Canada, the part supplier business would dry up. Likewise, if the part suppliers were not providing their component services, it would be difficult to attract and retain OEMs. Our business model aims to stabilize Canada’s auto industry by creating a brand that is intrinsically Canadian and that cannot be totally transported to other parts of the globe. In this regard, we are creating the first modern Canadian OEM that will operate in Ontario, building cars for the global market using Canada’s part suppliers wherever possible,” said Kaminski.

In January Dana TM4, a joint venture with Hydro-Quebec, unveiled an expanded series of the SUMO HP electric motors and inverters for electric vehicles. Dana

The company is in its early days, and Kaminski is trying to entice suppliers and manufacturers to get on board. That said, he already has ideas about the materials he wants to use.

“It is my belief that aluminum processing will become a core requirement. To reduce the costs of stamping sheet steel, folded aluminum sheet metal structures that are bonded together will form a good starting point for vehicle construction,” he said.

Shops looking for EV work also should consider the extensive infrastructure being built to power these vehicles.

The eCAMION company of Toronto, for example, designs, builds, and installs EV charging stations. The firm’s “Jule” charging stations are built around lithium battery-storage units and can be installed just about anywhere.

“This is Canadian technology. We built everything here with the University of Toronto and our own engineers. We’re the first ones in the world doing this,” said Carmine Pizzurro, eCAMION co-founder.

The company has installed energy storage systems in Toronto, Michigan, Ottawa, and Sudbury and the York Region in Ontario, as well as EV fast-charging stations in Ontario, Michigan, and Manitoba.

Jule charging stations provide power for electric cars, trucks, vans, and buses. This is important because Canada has a burgeoning electric heavy-duty vehicle (HDV) manufacturing sector that might also offer opportunities for machine shops. Leading firms in the HDV field include The Lion Electric Co., Build Your Dreams (BYD), Nova Bus, New Flyer, and GreenPower Motor Co. These companies manufacture electric buses and other HDVs.

The outcome of Project Arrow, Maple Majestic, and big EV investments from automotive OEMs remains unclear. If recent developments are anything to go by, however, EVs are poised to enter mainstream manufacturing circles in a big way.

“We really feel that the transition to electric vehicles is inevitable. We think that Canada’s auto sector needs to get on board, both to reduce greenhouse gases and to secure manufacturing jobs,” said Smith.

Clean tech meets EV

Clean technology expert Exro Technologies, Calgary, has developed a new class of power electronics for electric motors and batteries and is launching a new facility for automotive-class manufacturing.

The Maple Majestic (design shown here) is a hopeful entrant into the Canadian EV market. AK Motor Intl. Corp.

The new facility will feature 37,000 sq. ft. of production lines, product showrooms, and office spaces capable of producing units for its entire Coil Driver product line.

Providing a foundation for the company to grow over the next three years, the capacity of the facility is being designed to deliver up to an estimated 100,000 units per year across all the Coil Driver products, encompassing the entire product roadmap. This supports the company’s strategic milestones to focus on low-volume manufacturing while still using manufacturing partners and licensing contracts for future high-volume manufacturing.

The opening of the new facility will set the stage for Exro to execute on its strategic roadmap as a supplier to the automotive industry. It will be outfitted to meet certifications for ISO 9001:2015-, IATF 16949-, and ISO 26262-compliant product development.

Functional safety and quality management system planning is already underway and will be held to the highest regard to meet the expectations for optimized product delivery. The facility is scheduled to open before the end of 2021 for employees and automotive certified production by the end of 2022.

Exro’s current Calgary facility will continue to be a source for low-volume commercial products to the less regulated mobility applications with in-house design, testing, and assembly. It will remain the core innovation center for research and development, design and testing, and piloting prototypes for Coil Drivers, Battery Control Systems, and future technologies.

EV’s future in Canada

In a recent survey by KPMG Canada, 68 per cent of Canadians who plan to buy a new vehicle within the next five years are likely to buy an electric vehicle (EV), either pure or hybrid, although the lack of a robust charging infrastructure, battery life and range, and purchase price remain persistent concerns.

“Canada's automotive industry is nearing the tipping point, with nearly 70 per cent of Canadians indicating that they're looking to buy an electric vehicle not in a decade's time but in the next five years,” said Peter Hatges, partner, national sector leader, automotive, KPMG Canada. “Our poll research illustrates huge consumer demand in Canada for EVs, putting the onus on manufacturers and governments alike to shift gears not only to meet the expected surge in EV sales but to invest heavily in the necessary infrastructure.”

Key Findings

- 62 per cent of Canadians plan on buying a new vehicle in the next one to five years.

- 68 per cent of those buyers are interested in buying some form of EV.

- Men are more inclined to buy an EV than women (73 per cent versus 62 per cent, respectively).

- 79 per cent of those aged 18 to 44 say they are very likely or likely to buy an EV within the next five years, compared to 58 per cent of those aged 45 years and older.

- 83 per cent of Canadians believe the automakers should be required to invest in a national charging infrastructure.

- 89 per cent want EV charging stations installed at every gas station, as well as shopping malls and grocery stores.

The main reasons cited by those planning to buy a vehicle but not an EV are the high cost (60 per cent), limited driving range (51 per cent), lack of charging infrastructure (50 per cent), dubious battery lifespan (30 per cent), limited model options (24 per cent), and recharging time (24 per cent).

Contributing writer Nate Hendley can be reached at nhendley@sympatico.ca.About the Author

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Trending Articles

Sustainability Analyzer Tool helps users measure and reduce carbon footprint

Enhance surface finish with high-speed machining

Equispheres secures $20 million investment round

Solid carbide drills produce precision holes in short chipping materials

Okuma announces new personnel appointments

- Industry Events

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI

17th annual Joint Open House

- May 8 - 9, 2024

- Oakville and Mississauga, ON Canada

MME Saskatoon

- May 28, 2024

- Saskatoon, SK Canada

CME's Health & Safety Symposium for Manufacturers

- May 29, 2024

- Mississauga, ON Canada