- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Die/Mould Sector Report

How COVID-19, free trade, tariffs are affecting the industry

- By Nate Hendley

- May 28, 2020

- Article

- Health & Safety

Because the mould produced at Cavalier Tool & Manufacturing, Windsor, Ont., are large, 3D printing is not an economical option. The company is, however, looking at its first 3D-printed insert right now. Photo courtesy of Cavalier Tool & Manufacturing.

Tariffs, new technology, free trade deals, and changing automotive platforms are all challenging Canadian die and mould shops, while also creating potential opportunities.

On the challenges front, a gloomy economic report forecasts diminished automotive tool spending and shop closures. The overriding concern of the moment, however, is the COVID-19 pandemic, which has temporarily shuttered some North American auto plants and thrown the economy into turmoil.

“China is in a lockdown. Italy is in a lockdown. Those kinds of things will certainly put a challenge on any business,” said David Palmer, sales manager at Build-A-Mold in Windsor, Ont.

According to Mike Bilton, chairman of the Canadian Association of Mold Makers (CAMM), which is based in Windsor, volume mould suppliers are going to be particularly affected, given the reluctance of OEMs to buy tools from a jurisdiction affected by the coronavirus.

These jurisdictions include China, a key offshore source for high-volume moulds and a virus epicenter.

“The biggest thing in discussion now is the coronavirus. Tooling that we would utilize from some of our Chinese sources, obviously there’s an issue with that. Currently any tooling that is built in China that is shipped into the U.S. is subject to a 25 per cent tariff. It was rescinded, but as of Jan. 1 it was reimplemented. So for Build-A-Mold, we’ve either got to build it in-house or utilize a lot of our partners in the Windsor area for something that six months ago we would have gotten offshore,” said Palmer.

Given the rapid spread of COVID-19 in North America, however, sourcing moulds from virus-free domestic suppliers might be easier said than done. Just to make things worse, in mid-March GM, Ford, Fiat Chrysler, Toyota, and Honda announced they would be halting some vehicle production in North America to protect workers and clean their facilities. While temporary, such closures threaten to wreak havoc on the die/mould supply chain.

Making Plans

To come up with a game plan to cope with the pandemic, CAMM is working with a task force made up of local, provincial, and federal government representatives. It is heading up a manufacturing committee team focused on the die/mould/tool sector and creating a report on the impact of COVID-19 to develop options for short-term planning and long-term sustainability.

Yet even before COVID-19 reared its head, there were signs of trouble in the die/mould sector. In early November 2019, Michigan-based research firm Harbour Results released a report predicting that North American automotive tooling spending would fall to roughly $6.5 billion to $8 billion from roughly $8 billion to $10 billion annually in the next five years.

There have been fewer vehicle launches in North America from the Big Three domestic automakers, while OEMs everywhere are grappling with the transition to electric and autonomous cars, wrote Laurie Harbour, CEO of Harbour Results, in the report.

Temporary closures at The Big Three automakers threaten to wreak havoc on the die/mould supply chain. Photo courtesy of Cavalier Tool & Manufacturing.

Looking to the Future

The lack of new vehicle models means less demand for stamping dies and plastic moulds. As a result, 50 to 75 die and mould shops might go out of business in North America over the next five years, noted the report.

Industry representatives agree with some of Harbour’s warnings but not her pessimistic predictions.

“Laurie was right. There will be some hurt. She is a wakeup call for the shops,” said Mike Hicks, CAMM director-at-large and director of sales at DMS, a supply firm for die/mould shops in Oldcastle, Ont. “[Shops need to] get the attention of people. Make sure you are best-in-class, the best you can be, or find new markets. It’s not going to be business as usual, but I do not think things are going to be at the levels she mentioned.”

“I don’t think she’s on the money. She leaves out a lot of factors, one of which is that mouldmakers are quite resilient. She does make some really good points, though,” said Jonathon Azzopardi, CEO of Laval Intl. in Tecumseh, Ont., and head of international affairs at CAMM.

When asked, industry representatives offered a slew of survival tips, based on the Harbour Results report. This advice has taken on new urgency, given COVID-19.

“I don’t want to use the numbers [from the Harbour report] to say, ‘The sky is falling,’ but I believe in the message she’s sending—be conservative in your spending, use data, and form relationships,” said Bilton.

At the same time, it’s vital to keep your machinery, software, and equipment up to date, he added.

This is particularly true if you’re looking to form a partnership with a Tier 1 or Tier 2 supplier.

“Collaboration is a great thing; forming relationships or even a partnership. I’ll invest in new machines and equipment if it means we can hold hands and go into the future for five to 10 years,” said Bilton.

Become More Efficient

Other evergreen tips are reduce waste, invest in technology, and speed up your processes.

Automation keeps workers from having to go up on the machines six or seven times. Photo courtesy of Laval Intl.

“Buy software to do faster, more efficient cutting paths, and automate more so your guys aren’t going up on the machines six or seven times. All those things make you leaner,” said Azzopardi.

Bilton pointed to predictive technologies, the latest machining capabilities, and lightweight materials as important trends that should be in the crosshairs of tool shops.

Predictive technologies include remote monitoring, machine connectivity, and the internet of things (IoT).

According to Bilton, these high-tech tools let shop owners gather data from the field to be able to choke back or ramp up maintenance schedules for machines and adjust cutter speeds, among other things.

He also pointed to lightweighting as a trend to watch.

“For the past two years, it’s been the No. 1 ‘megatrend,’ especially in automotive. Aviation and aerospace have been doing it since conception, but automotive really has embraced the lightweighting initiative lately,” he said.

This is because of regulations passed under former President Obama’s administration that set strict rules about improved fuel efficiency in traditional gasoline engines. The advent of electric and autonomous cars has also spurred moves to making vehicles lighter while also stronger.

Is Additive Manufacturing the Answer?

Industry experts give mixed reviews about additive manufacturing (AM). The 3D printing process remains very slow, making it unsuitable for high-volume automotive production. Given that auto work is a mainstay of the die/mould sector, 3D printing won’t replace conventional mouldmaking methods any time soon.

It can augment traditional methods, however.

“Has [3D printing] assisted in the prototyping process? Absolutely,” said Palmer.

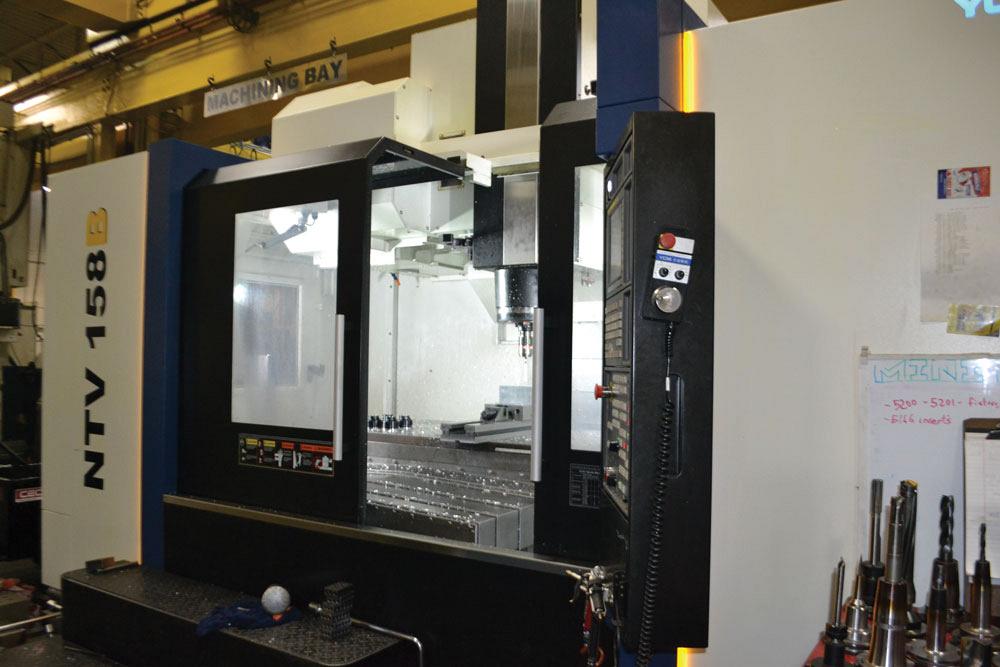

It’s vital to keep your machinery, software, and equipment up to date, particularly if you’re looking to form a partnership with a Tier 1 or Tier 2 supplier. Photo courtesy of Cavalier Tool & Manufacturing.

While 3D printing could be used to make low-volume tools in the near future, any assignments requiring high volumes will still done by traditional means, he added.

Tim Galbraith, sales manager at Cavalier Tool & Manufacturing in Windsor, offered a slightly different take on AM.

“Our moulds are large, so 3D printing is not an economical option. We are, however, looking at our first 3D-printed insert right now. I don’t think there’s anybody in the world that will tell you that additive manufacturing is not the wave of the future. We’ve been using subtractive manufacturing forever, cutting chips away. When [additive] technology gets to the point where it is cost-effective, it will take over. But for right now, we’re just dabbling a little bit,” said Galbraith.

Talking Politics

In terms of political developments, industry leaders are delighted that tariffs on imports of aluminum and steel have been lifted and at the prospect of a new North America free trade deal.

While in place, the tariffs were very restricting.

“Although Canada has a vibrant, growing steel industry, we buy the majority of our steel from the U.S. because they have the foundries. As we were getting penalized for bringing that steel in, it was really impacting our business. We all tried to find new sources wherever we could. A lot of the sources in Canada had already brought in a large amount of metal, enough to get us through, but there obviously wasn’t enough there,” said Azzopardi.

The Canada-U.S.-Mexico Agreement (CUSMA), as it is called in this country, looks to be a done deal. This new free trade agreement will supplant NAFTA.

“We were lucky enough to go and testify in front of the Standing Committee in Ottawa. It’s good for manufacturing in Ontario. We need to have that passed,” said Galbraith.

“We’re excited to move into the new agreement, CUSMA. I gave testimony about that in Ottawa. I basically told them, ‘You have to ratify this,’” added Azzopardi.

Sector Needs Workers

A perennial concern remains the lack of young people entering the skilled trades to replace older, retiring workers.

High-tech tools let shop owners gather data from the field to be able to choke back or ramp up maintenance schedules for machines and adjust cutter speeds, among other things. Photo courtesy of Laval Intl.

Azzopardi described the Ontario Youth Apprenticeship Program (OYAP), a provincial initiative to get highschool students involved in skilled trades, as “a gift to our young people. It’s probably the best thing that was ever introduced to our industry when it comes to trying to attract youth right out of high school.”

The Ontario provincial government also recently unveiled a new $10 million initiative called the Ontario Automotive Modernization Program (O-AMP). It funds up to half of an eligible project aimed at upgrading a shop up to $100,000.

“It has provided some companies the means to embrace and adopt hardware, software, new technologies, or even bring in new consultants or subject matter experts to help optimize efficiencies in process or product. Great program,” said Bilton.

In early 2019 CAMM helped launch a new organization called Automate Canada, which is intended to represent the interests of the manufacturing automation industry. Automate Canada will focus on the latest technologies and applications in the sector, said Bilton.

“We believe there’s a really good marriage between automation equipment and mouldmakers,” said Azzopardi.

The main challenge facing the die/mould sector at present, however, is simply getting through the COVID-19 pandemic.

“Mouldmaking is still strong. We have a great integrated supply chain, something most other mouldmaking hubs in the world do not. If I want steel, I’ve got steel. I’ve got injector pins, I’ve got heat treatment. All these things are in the Southwest Ontario market. So, the supply chain is strong, and that gives us a great advantage when dealing with competition around the world,” said Galbraith.

Contributing writer Nate Hendley can be reached at nhendley@yahoo.ca.

Build-A-Mold, www.buildamold.com

Canadian Association of Mold Makers, www.canadianassociationofmoldmakers.com

Cavalier Tool & Manufacturing, www.cavaliertool.com

Laval Intl., www.lavaltool.net

About the Author

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Trending Articles

Sustainability Analyzer Tool helps users measure and reduce carbon footprint

GF Machining Solutions names managing director and head of market region North and Central Americas

Mitutoyo updates its end-user portal

Enhance surface finish with high-speed machining

CME's Health & Safety Symposium for Manufacturers

- Industry Events

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI

17th annual Joint Open House

- May 8 - 9, 2024

- Oakville and Mississauga, ON Canada

MME Saskatoon

- May 28, 2024

- Saskatoon, SK Canada

CME's Health & Safety Symposium for Manufacturers

- May 29, 2024

- Mississauga, ON Canada