- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Vertical Integration Is a Risk That Pays Off

Cozy up to the end user to provide what’s needed to grow your company

- By Anne Kershaw

- July 27, 2014

- Article

- Management

With the final customer as the locomotive in the value train and contributing manufacturers as the cars, the cars closest to the engine will be able to see the customer’s new directions, innovate and adapt to meet the new needs, and grow by continually adding value to the end product. The closer to the locomotive, the clearer the view.

Think carefully about the effect that outsourcing parts of a manufacturing process can have on your company’s capacity to innovate and its ability to compete in the global market before letting go of in-house capabilities.

“I’ve seen the dismantling of many companies,” said Ross Bradsen, advanced manufacturing sector lead for Ontario Centres of Excellence (OCE), an innovation and commercialization organization. “I’ve seen them lose their innovation capacity, become less interested in new products and in listening to customers, less interested in new markets and less driven.”

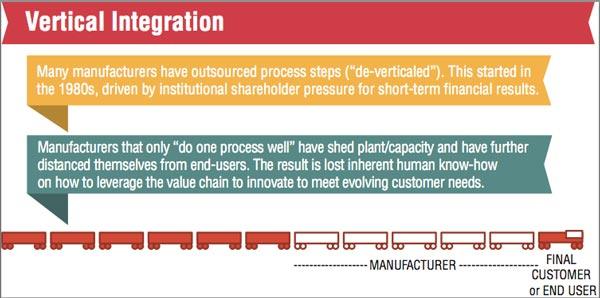

Bradsen points to a trend starting in the ‘80s in which manufacturers increasingly outsource process steps under pressure from institutional shareholders for short-term financial results. This inclination has been particularly pronounced in Canada, where relatively few large and medium- sized companies are owner-operated. In contrast, over 70 percent of Germany’s manufacturing workforce is employed by the owner-operated, export-powerhouse Mittelstand companies that focus on the best longterm interests of their products’ end users and resist short-term financial interests.

Once a business narrows its focus to fewer manufacturing process steps and begins divesting plant capacity and human resources, it inevitably loses competence in places where process and product innovation can take place. Moreover, they often distance themselves from the product’s end users. When your immediate customer in the value chain is far from the end user, you are blinded to opportunities to innovate to meet evolving needs, he said.

Vertical Integration Creates Value Opportunities

A vertically integrated company performs all or many manufacturing processes in-house, adding value at each step.

“A highly vertically integrated firm might buy plastic pellets; melt them; blow plastic film; form and laminate the film into bubble-wrap; then process the bubble-wrap into padded envelopes, swimming pool covers, insulation, and packaging material,” Bradsen said. “A nonvertically integrated company might just make film and sell it onto the general market. It may not know the end use or what other steps are adding value.”

The idea of outsourcing to save money can be appealing, but if the savings are not reinvested in innovative new products to meet end user needs, a firm eventually weakens while the other firms in the value chain—perhaps future competitors— grow stronger.

“The more you do in-house, the more control you have over your own destiny, and the more capacity you have for greater innovation,” Bradsen said.

To make this point, Bradsen used the image of a train pulling multiple cars where the locomotive is the end user. If your business represents one of the cars near the back of the train, you are very distant from the locomotive— or end user—and will have little knowledge of your customer’s changing requirements and how to meet them. He said, “You want to be as close as possible to the locomotive to fully, and always, understand what needs are pulling your train.”

In 2010 product innovation joined the list of requirements for any manufacturer interested in growth.

Embrace Risks to Grow Profits

Another advantage to being closer to the end user of the product is that product margins and overall revenue are typically much higher.

“The more you are visible to the end user with unique, desirable products, the more of a premium you can charge and, if reinvested, the faster your company can grow.

“At a time when markets are expanding internationally, many Canadian businesses appear complacent about the growing opportunities to export goods and are unaware that they can leverage Canada’s diversified workforce and their global connections to better understand international opportunities and sell to the world.”

Bradsen continued, “Manufacturing leaders should ask themselves whether they are operators or innovators. What distinguishes an innovator from an operator is the emphasis that is given to customer problemsolution, R&D, new products, and new markets. Innovators also need to know how to raise the funds to innovate and grow, just as a start-up company does. Innovation requires taking risks, and that includes risks in the financial arena.

“There is a tendency for small manufacturers to focus almost exclusively on small local markets with no thoughts of trying to sell to Brazil, India, or Indonesia. It’s difficult to know whether this is due to fear of the unknown, a risk-averse culture, or simply a branch-plant mentality.”

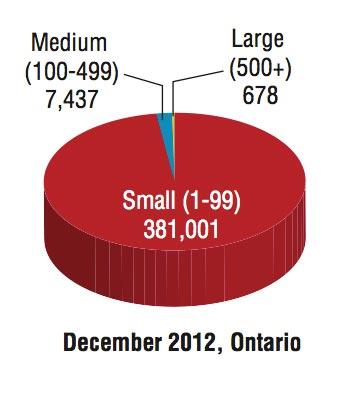

Whatever the reason, according to Bradsen, the result is a Canadian economy that is heavily dominated by small businesses. He pointed out that in Ontario, for example, only 8,000 companies are classified as large or medium (more than 100 employees). The vast majority, 381,000, rank as small businesses.

Innovation Is a Necessity

For decades manufacturing has been driven by the obligation to deliver on three fronts: quality, cost, and delivery. By 2010 the ability to innovate had moved onto the list.

For Canada, whose economy has been so profoundly shaped by the country’s immense size and abundant natural resources, the question is whether more vertically integrated companies can be fostered to add more value here at home.

The Ontario economy is dominated by small businesses. Industry Canada reported that as of December 2012, 381,001 of Ontario’s 389,116 businesses had fewer than 100 employees.

Bradsen said it can be done. “We have the capacity to build an economy driven by innovation. That capacity includes our diverse workforce made up of people from around the world; a world-class education system; and rich potential in all major sectors including energy and the environment, advanced manufacturing, advanced health services, and digital technology.”

As the largest sector of the economy, big manufacturing has undergone a major transformation over the past decade. Process automation and new technologies have been incorporated at a rapid pace. Bradsen said it’s time for small manufacturing to follow that trend and “grow up.”

Advanced manufacturing companies that have ambitious leadership with the desire to innovate, lead, and stay ahead but need funding assistance are recipients of close to 30 percent of OCE’s investments.

Bradsen believes future success depends on a willingness to resist short-term financial gains while focusing on the end user and enhancing innovative capacity.Requirements joining the focus on innovation, he said, include:

•Establishing government incentives to encourage owner-operators to hold onto their companies until they become global leaders.

•Developing vertical integration within companies to keep them close to their end users.

- Charging premium prices for superior products.

- Exploiting the economies of scale by selling to every corner of the world.

- Leveraging Canada’s multicultural workforce.

Graphics courtesy of OCE.

Ontario Centres of Excellence Invests in Innovation

In partnership with industry, Ontario Centres of Excellence (OCE) co-invests in the commercialization of innovations originating in the province’s colleges, universities, and research hospitals. The investments foster the training and development of the next generation of innovators and entrepreneurs.

A champion of leading-edge technologies, best practices, and research, OCE invests in sectors such as advanced materials and manufacturing, information and communications technologies, digital media, agrifood, aerospace, transportation, energy, health, and the environment including water and mining.

OCE is a key partner in delivering Ontario’s Innovation Agenda as a member of the province’s Ontario Network of Entrepreneurs (ONE), funded by the government of Ontario. ONE, comprised of regional and sector-focused organizations, helps Ontario-based entrepreneurs and industry rapidly grow and create jobs.

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Trending Articles

- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI